We think to Portfolio Management as a trampoline.

A powerful sling, able to impress tremendous acceleration to selected strategic and innovative initiatives, while though slowing down and stop other ones that are not delivering the expected results.

However, most organizations implement portfolio management like conveyor belts from which initiatives are somehow mechanically pushed into the delivery machine through a phase-dumb-gate approach, usually not being able to measure actual results and thus not being courageous enough to stop bad ones.

This article suggests some Agile and Lean portfolio management practices that have the potential to steadily allow organizations to move away from their status of barely survival, towards more exciting and prosperous places.

![]()

The more fluid the context in which organizations live, the more frequently strategic decisions should be taken. The more frequent strategic decisions are taken within a company, the more adaptive product development must be.

While this seems simple, it implies the capacity to carefully listen to market and customers, being able to separate valuable weak signals from noise and entropy (see my previous post here).

But that’s not enough.

Once a new emerging necessities has been understood, companies need to take immediate actions to exploit it by envisioning what new solutions can be created, how to fund them, prioritizing related work and reserving the right resource and people to work on them.

All this must be done quick and good enough to not lose the potential advantage.

Most of the time the problem we see with our clients is not about having dozens of agile cross-functional and self-managing teams, working according to one of the Agile frameworks today available.

The problems stays with: traditional way of managing budgets, phase-gate portfolio management approaches and, if not waterfall, mechanical kind of “iterative-incremental” development approach.

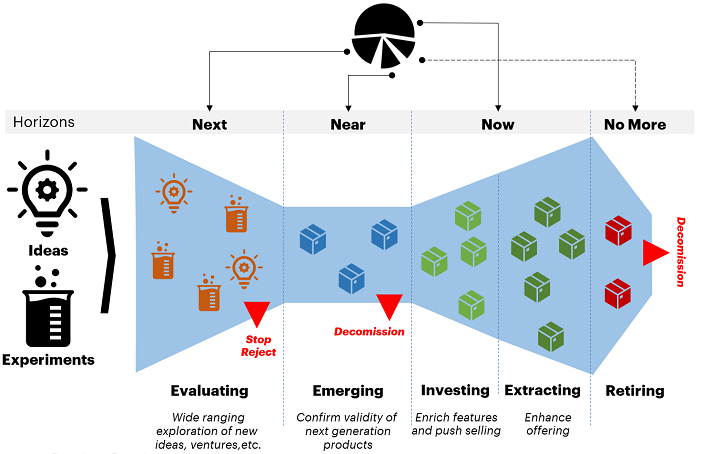

Investment Horizons

In order to be ready to invest in new opportunities, as well as to react to any feedback regarding mature products and services already present in the market, organizations need to dedicate the right amount of resources to the different phase of products’ life-cycles.

A useful tool that can be used for such a purpose is the Investment Horizons.

Horizons have been thought to represent the four main phases of a product life-cycle, to which can be associated:

- what kind of activities should be executed and

- what percentage of budget to dedicate.

The horizons are:

Next: any ideas that should be tested or experiments to execute in order to validate new emerging technologies or opportunities. New ventures, startups on which to invest.

The approach is to have several running small-initiatives that range horizontally and vertically.

Near: the initiatives which survived the previous phase (Next), have seen proven their hypothesis; the results coming from the market demonstrated customers interest, while the gathered feedback showed new features to explore and any flaws to fix. These ones are next generation solutions on which to steadily invest in order to let them grow in their market share and maturity.

Now: these are the products having a large market share within a mature industry, which produce consistent cash flows over its lifespan. Products whose profits are used to finance investments in one of the other horizons. Two dedicated strategies need to be adopted according to their actual longevity:

- Investing. These products are the younger and companies need to invest to enrich their features, push selling to increase market share.

- Extracting – These products are the ones that are getting closer to their end-of-life, thus it is needed to extract as much value as possible by enhancing their offering.

No More: this horizon regards those products who actually reached their end-of-life. New development or enhancements costs are more than potential revenues. Companies need to dedicate money to retire them from the market, substituting them and developing campaigns to move customers to new solutions.

One interesting concept of the diagram above reported, regards the Stop/Reject and Decommission red labels.

This concept has to do with the ability of organizations to recognize when an initiative is not worth investing anymore due to its scarce results. Even if this seems common sense, a logical thing to do, reality is quite different.

Adaptive Product Development

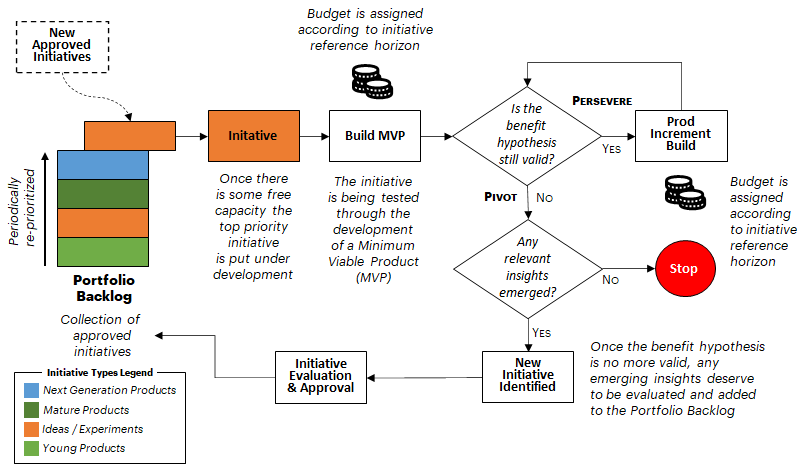

Once a new initiative has been approved by the Lean Portfolio Management Team, it should be accompanied to development phase having in place some virtuous mechanisms able to inject flexibility and responsiveness to the whole production process.

Eric Ries in his book “The Lean Startup” described how Startups, since from their birth, could continually make hypothesis and explore them by developing minimum viable products (MVP), which bring the necessary learning that eventually confirm or deny their validity.

This approach can be inherited by and adapted to any organization who wants to be adaptive enough to market continuous fluctuations.

Accepted initiatives are stored in the Portfolio Backlog and periodically prioritized. Once there’s available capacity, people and teams who can work on it, the top priority initiative is pulled and the relative budget reserved to the relative horizon is used – in the diagram above, the orange initiative belongs to Next horizon.

Once the MVP has been built, its benefit hypothesis statement is verified to decide whether to Persevere, to Pivot or to Stop the initiative. While Persevere (continue the development phase) and Stop (avoid to invest more budget and abandon development) decisions are obvious, Pivot needs some clarifications.

An MVP is a small part of a product which can be actually used by customers and represents the smallest investment that a company can make to gather information, data to understand if it is deemed valuable or not.

This implies that companies need to spend the less money and time possibile to get to market to gain the maximum amount of learning to decided whether to continue or not.

Many times emerging insights do not confirm our hypothesis. This is actually good because helps us avoid to spend additional money and to save it for the future.

However, at times it happens that the insights gathered suggest to walk alternative paths, investing and developing different new products which eventually can lead to unexpected great results. There are plenty of examples of products that are today well known and that were born as different ideas – e.g. YouTube was originally a video dating Website, Twitter started out as a Website from where people could download podcasts, where Flickr was thought as an online role playing game called Game Neverending.

Well, being able to continue the development iteratively and incrementally, or stop it or, even more drastically, pivot and change idea on what to develop, leads to significant change on how budgeting processes must be applied in those companies who want to use adaptive development.

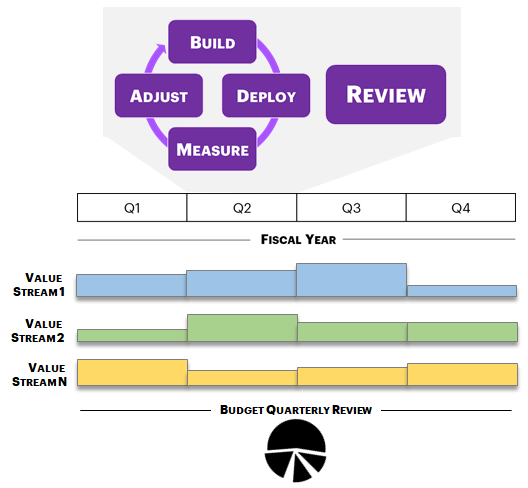

Lean-Agile Budgeting

In order to quickly invest in new products or services, as soon as market opportunities arise, organizations needs to adopt adaptive funding models.

Lean-Agile budgeting approach aims to shift from traditional funding of projects over assigning budgets to value streams, avoiding to:

- creating detailed plans based on difficult-to-make projections,

- annual basis budget planning,

- being mostly concentrated on checking if projects are on time and on budget – instead of focusing on steady release of value –

- move people from one project to the other (move people to work), instead of creating stable teams (move work to people)

In order to being able to apply Lean-Agile budgeting there are two important preconditions that must be present:

- the ability of the organization to go to market frequently (weeks) and

- the discipline to measure results.

If those two are in place, companies are able actually review results of launched initiatives, their consumed and remained budget and to decide where to invest available budget according to any new emerging opportunities or insights, and eventually redistributing money to maximize potential future value for the company.

We know that applying those three Lean-Agile practices means significant change for organizations.

But this can make the real difference for organizations who want to move from surviving to thriving.